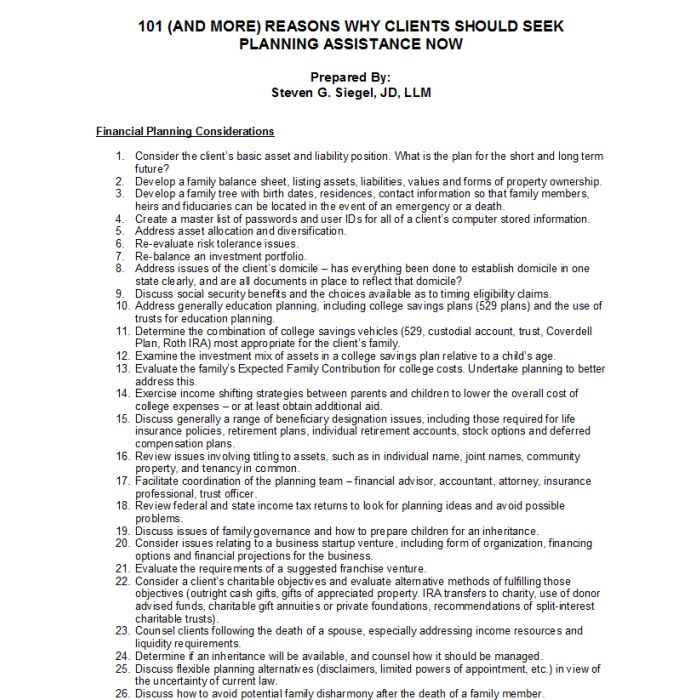

101 (And More) Reasons Why Clients Should Seek Planning Assistance Now (5 Pages)

FREE FORMS: In order to obtain this Free Form, please:

1. click the above "Add To Cart"

2. proceed with Checkout and then

3. if you already have an account, merely login or if you do not yet have an account, just create an account.

You do NOT need to enter any credit card information unless you are purchasing other forms.

A concern common to all estate and financial planners is “How Do I Get My Clients to Realize How Important it is to Do Planning?” Regardless of how knowledgeable and skillful the planner may be, getting in front of a client and motivating that client to take positive actions is an ongoing challenge for all of us.

FREE FORMS: In order to obtain this Free Form, please:

1. click the above "Add To Cart"

2. proceed with Checkout and then

3. if you already have an account, merely login or if you do not yet have an account, just create an account.

You do NOT need to enter any credit card information unless you are purchasing other forms.

A concern common to all estate and financial planners is “How Do I Get My Clients to Realize How Important it is to Do Planning?” Regardless of how knowledgeable and skillful the planner may be, getting in front of a client and motivating that client to take positive actions is an ongoing challenge for all of us. Clients do not have to be especially wealthy or old or ill to need planning. Many planning issues are best addressed when assets are modest and youth and good health are present. We have compiled a list of suggested reasons to plan and issues to be addressed thanks to the contributions of a number of talented people working as financial planners, accountants, attorneys, trust officers and insurance agents (to whom we gratefully acknowledge their contributions) in an effort to share our collective best ideas to motivate both clients and their planners to get the planning process underway.

The suggestions below are not intended to be listed in any order of suggested importance – nor does their inclusion in one category suggest they are in any way exclusive to that category. To the contrary – financial, estate, tax, retirement and insurance planning is a collaborative process. Many skills and talents are needed to be brought together to best serve the interests of our clients.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].