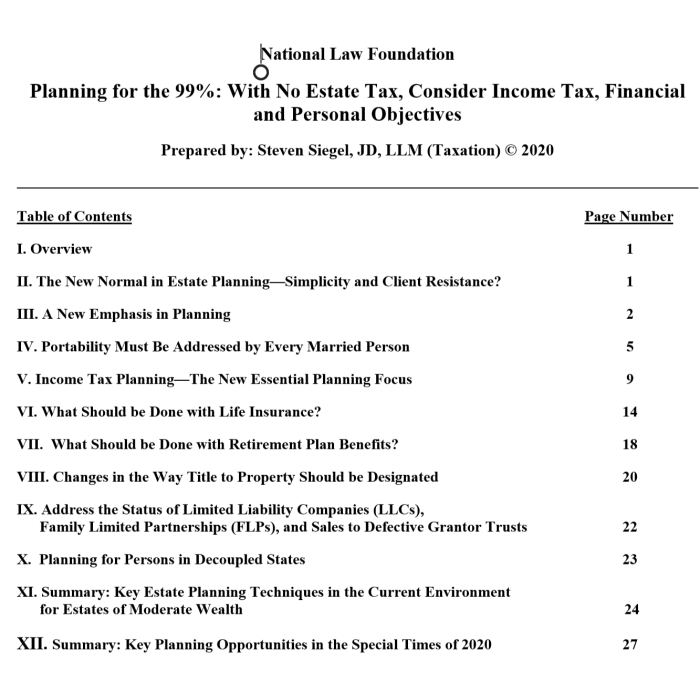

Planning for the 99%: With No Estate Tax, Consider Income Tax, Financial and Personal Objectives - 2020 Edition (28-Page Book)

Released March 31, 2020 - Written by Steven G. Siegel.

The estate planner has new challenges—the majority of our clients’ estates will not be subject to the federal estate tax when death occurs. How are we to plan for them—and indeed, convince them that planning is still important and necessary? This outline discusses the new reality in financial and estate planning.

2020 is a special year. As the result of the Covid-19 virus, our lives and our clients’ lives have been uprooted like never before. Focus for many has turned to earning income, paying bills and employees, and of course, protecting our families and ourselves. Income tax filings and payments are delayed, required minimum distributions from retirement plans are suspended for 2020, penalties for early withdrawals from retirement plans are excused, and allowable loans from 401k plans are increased. The government is trying to keep employees and employers afloat with a wide range of relief provisions.

With the virus and the new law provisions confronting us daily, we may lose sight of the need for other planning considerations. That would be a mistake. The combination of the available generous transfer tax exclusions, the decline of the stock market, the low market interest rates and the concern about political risk presents a “perfect storm” of planning opportunity. As difficult as it may seem, we need to look beyond the terrible virus story and consider planning opportunities for our clients and ourselves.

Mr. Siegel gives many useful Planning Suggestions and Practical Examples. See sample pages above for the complete Table Of Contents.

Related Form(s): See links below for related forms.

Related CLE Courses: to listen to, and obtain CLE/MCLE credits in those states for which they are listed, please visit our sister sites, www.NLFonline.com (online courses) and www.NLFcle.com (courses on CD and DVD), click on your state and scroll to these titles - "2017 Tax Cuts And Jobs Act", "A-B Disclaimer Trusts", "Estates, Trusts, Gifts and GST Provisions of the 2017 Tax Act", "Individual Income Provisions of the 2017 Tax Act" and "Planning With Dynasty Trusts".

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012). In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles. Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH, National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies. He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools. Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.

-

3 Irrevocable Life Insurance Trusts (75 Pages)Special Price $199.00 Regular Price $237.00

3 Irrevocable Life Insurance Trusts (75 Pages)Special Price $199.00 Regular Price $237.00