Affidavits Needed At Closing: Carbon Monoxide, Smoke Detector, F.I.R.P.T.A, and Heirship Affidavit - New York Forms (4 Pages)

Carbon Monoxide

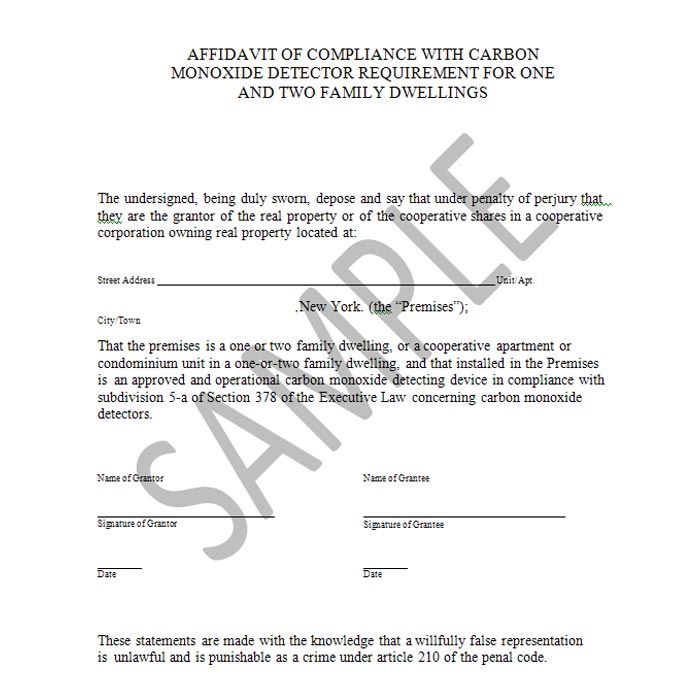

Executive Law §378 (5) requires proof of installation of operable Smoke detectors. In 2002, the law was amended as §378 (5-a) to additionally require that an operable carbon monoxide detector be installed in a one or two family dwelling and any dwelling in buildings owned as condominiums or co-operatives.

Smoke Detector

Executive Law §378 (5) requires that a smoke detector affidavit be provided by transferor to transferee.

F.I.R.P.T.A

The requirement for Seller to submit this document at closing is pursuant to Section 1445 of the Internal Revenue Code 26 U.S.C.§ 1445. Its purpose is to assure that the U.S. government is able to collect any capital gains tax realized on the sale even if seller is a non-resident alien who may be leaving the country.

Heirship Affidavit

If the transfer involves a decedent's probatable estate this fiduciary's affidavit, required by the title company, which along with Death Certificate and Will, clarifies rights of beneficiaries, existence of Probate proceedings, Letters Testamentary, need to post bond, etc.

Carbon Monoxide

Executive Law §378 (5) requires proof of installation of operable Smoke detectors. In 2002, the law was amended as §378 (5-a) to additionally require that an operable carbon monoxide detector be installed in a one or two family dwelling and any dwelling in buildings owned as condominiums or co-operatives. It was further amended in 2005 to include dwellings with attached garages.

Smoke Alarm and Carbon Monoxide Detector Affidavits can be combined into a single affidavit.

Smoke Detector

Executive Law §378 (5) requires that a smoke detector affidavit be provided by transferor to transferee. This affidavit, produced at closing attests to compliance with operational smoke detector installation requirements for one and two family dwellings or a co-operative apartment or condominium unit.

New York City requires that this affidavit be submitted for filing along with transfer tax returns and deed.

Executive Law § 378 (5) was amended in 2002 to additionally require an operable carbon monoxide detector be installed. It is possible to combine both affidavits into one form.

F.I.R.P.T.A.

The requirement for Seller to submit this document at closing is pursuant to Section 1445 of the Internal Revenue Code 26 U.S.C.§ 1445. Its purpose is to assure that the U.S. government is able to collect any capital gains tax realized on the sale even if seller is a non-resident alien who may be leaving the country.

If on the certification form or an affidavit, Sellers can declare that they are not non-resident aliens for purposes of U.S. income taxation and Sellers provide social security number or Federal tax payer I.D. number, Purchasers (transferees) will not be required to withhold 10% of purchase price in escrow pending determination of amount due to I.R.S. on gain. In effect, transferee serves as withholding agent for the Federal government.

Heirship Affidavit

1. If the transfer involves a decedent's probatable estate this fiduciary's affidavit, required by the title company, which along with Death Certificate and Will, clarifies rights of beneficiaries, existence of Probate proceedings, Letters Testamentary, need to post bond, etc.

2. If the transfer involves an intestate proceeding, this fiduciary's affidavit provides identity of distributees, existence of Letters of Administration, need to post bond, etc.

3. If this is not a transfer out of an estate but the title examiner finds an inexplicable break in the prior chain of title involving a prior record owner, this affidavit helps title company to establish heirship and marketable title.

Author:

CLAIRE SAMUELSON MEADOW, Esq. is in the private practice of law, concentrating in real property transactions. In addition, she works on title matters as a consultant, attorney and representative for a New York based title agency. She is the author of numerous real estate articles distributed to lawyers, and she has appeared on the General Practice “Hot Tips” panel at the New York State Bar Association’s Annual Meeting. Recently, she has been presenting Continuing Legal Education-credit programs on real estate and title matters to the Westchester County Bar Association, the New York County Bar Association and the National Law Foundation. Mrs. Meadow authored the residential real property chapters of the New York Lawyer’s Deskbook and Formbook for more than 12 years.

Before entering private practice, Mrs. Meadow was a staff attorney in the Enforcement Division of the Securities and Exchange Commission’s New York regional office. She is a Phi Beta Kappa, cum laude graduate of Hunter College, Class of 1959, and a graduate of Columbia Law School, Class of 1962, where she was a recipient of a Moot Court Scholarship.

Mrs. Meadow is listed in Who’s Who in American Women and Who’s Who in American Law. She is a recipient of a Westchester County Woman of Achievement Award and a Certificate of Special Congressional Recognition from Congresswoman Nita M. Lowey for “outstanding and invaluable service to the community.”

Mrs. Meadow was a founding member of the New York State Women’s Bar Association, Westchester County, and its first recording secretary. She is also a member of the New York State Bar Association, Real Property Committee; the Westchester County Bar Association; and the New Rochelle Bar Association.

Don’t think this attorney has a narrow horizon. She chaired the Westchester Women’s Bar Association Annual Golf Outing for six years causing it to become such a popular community event that, in some years players had to be turned away.

Mrs. Meadow welcomes inquiries by new lawyers and general practitioners concerning basic real estate or title matters. She may be contacted at 914-834-6472.