Asset Protection Planning: An Introduction (93-Page Book)

Released October 26, 2012 - Written by Gideon Rothschild, Esquire and Daniel S. Rubin, Esquire.

Click the above "Learn More" button to read the Table of Contents, several Sample Pages and Mr. Rothschild's and Mr. Rubin's curriculum vitae.

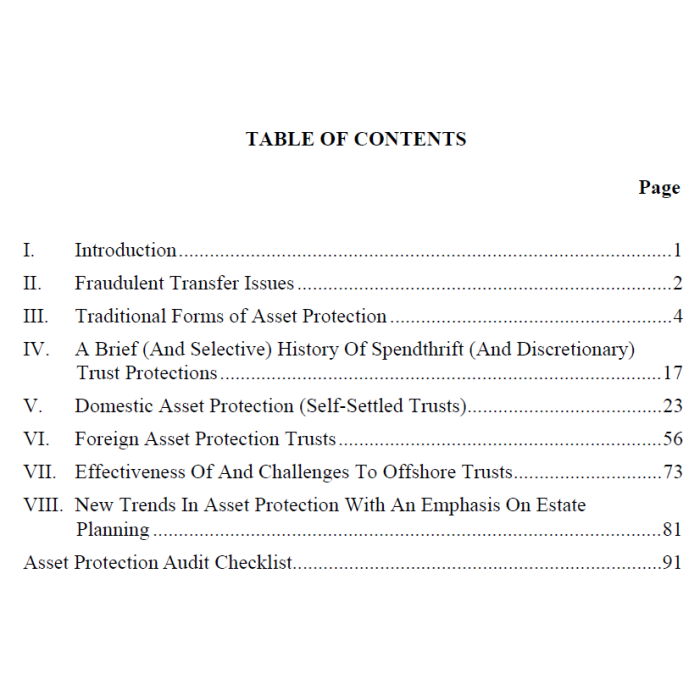

See sample pages above for the complete Table Of Contents. Alternatively, here are the main topics covered in this book:

I. Introduction

II. Fraudulent Transfer Issues

III. Traditional Forms of Asset Protection

IV. A Brief (And Selective) History Of Spendthrift (And Discretionary)

Trust Protections

V. Domestic Asset Protection (Self-Settled Trusts)

VI. Foreign Asset Protection Trusts

VII. Effectiveness Of And Challenges To Offshore Trusts

VIII. New Trends In Asset Protection With An Emphasis On Estate Planning

Asset Protection Audit Checklist

Related Form(s): links to related Forms on this site appear immediately after the below "Author" curriculum vitae.

Authors:

Mr. Gideon Rothschild

GIDEON ROTHSCHILD is a partner with the New York City law firm of

MOSES & SINGER LLP, where he co-chairs the Trusts & Estates and Wealth

Preservation Group. He focuses his practice in the areas of domestic and

international estate planning techniques for high net worth clients and is a

nationally recognized authority on wealth preservation and offshore trusts.

Mr. Rothschild is the Vice-Chair of the Real Property Trust & Estate Law

Section of the American Bar Association, a Fellow of the American College of

Trust and Estate Counsel and Academician of The International Academy of Trust

and Estate Lawyers. He is the Immediate Past Chair of the New York Chapter of

the Society of Trust and Estate Practitioners (STEP), and a member of the

New York State Bar Association.

Mr. Rothschild is the co-author of the BNA Tax Management portfolio on

Asset Protection Planning and a member of the Advisory Boards of BNA’s

Tax Management and Trusts and Estates. . He has also authored numerous articles

for publications including the New York Law Journal, Trusts and Estates and Estate

Planning.

He has lectured frequently to professional groups including the University of

Miami’s Philip Heckerling Institute, the New York University Federal Tax Institute,

the New York State Bar Association, the American Bar Association, the Southern

Federal Tax Institute and the American Institute of Certified Public Accountants.

Mr. Rothschild has been designated as a Distinguished Estate Planner by the

National Association of Estate Planners and Councils and has earned the distinction

of being listed in Chambers USA ("in addition to his extensive experience in

domestic and international estate planning, is regarded by peers as ‘a leading

authority on asset protection’."), Best Lawyers in America, New York Superlawyers

(Top 100 in New York City in 2010 and 2012) and Worth’s Top 100 Lawyers.

Mr. Rothschild is also licensed as a Certified Public Accountant.

Mr. Daniel Rubin

DANIEL S. RUBIN is a partner in the Trusts and Estates and Asset Protection

practices of the New York City law firm of Moses & Singer LLP where he

concentrates his practice on domestic and international estate and asset protection

planning for high-net-worth individuals and their families.

Daniel has been named by Worth magazine as one of the "Top 100 Attorneys"

in the nation for private clients, by Law & Politics as a "New York Super

Lawyer" for 2007-2011, and by Best Lawyers - U.S. News & World Report as one

of The Best Lawyers in America® in the area of Trusts and Estates for 2009-2011.

Daniel is the co-author of the third edition of the Bureau of National Affairs’

Tax Management Portfolio on Asset Protection Planning, No. 810-3rd, and is a

Fellow of The American College of Trust and Estate Counsel, a member of the

Society of Trust & Estate Practitioners, Secretary of the Estate Planning Council

of New York and the co-chair of the International Planning Committee of the

New York State Bar Trust & Estate Section.