3 Delaware LLC Forms: Certificate of Formation for Delaware Series Limited Liability Company (1 Page), Delaware Series Limited Liability Company (45 Pages), and Operating Agreement For An Investment Series Delaware LLC (40 Pages)

SAVE $38 when you purchase all (3) Delaware LLC Forms.

Click "Learn More" above for more information about our 3 Delaware LLC Forms. Alternatively, each Delaware LLC Form may be purchased individually.

All 3 Delaware LLC Forms are included. To read a longer description, click the name of the Delaware LLC Form below.

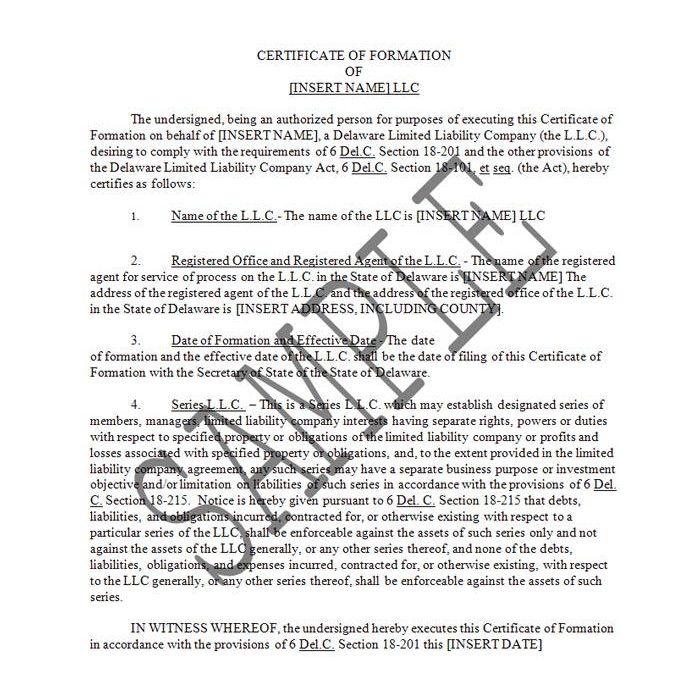

Certificate of Formation for Delaware Series Limited Liability Company (1 Page) $19

This Form is a Certificate of Formation to be used in the creation of a Delaware Series LLC. It can be signed by one of the Members, or by another person authorized by the Members to act on their behalf.

Delaware Series Limited Liability Company (45 Pages) - $59

This is a Form of Limited Liability Company Agreement for a Delaware Series LLC. Delaware statutes allow a single LLC to have any number of Series associated with it that are part of the LLC for identity and reporting purposes, but are separate entities for governance, membership and liability purposes.

Operating Agreement For An Investment Series Delaware LLC (40 Pages) $59

This Form is a Delaware LLC Operating Agreement created to allow a variety of Investment Series. This Agreement allows members who are participating in the LLC to elect to opt in or out of a particular investment of the LLC in their discretion. They may do so by participating or not participating in each Series as it is proposed and funded. Refusal to participate in a particular Series does not void their participation in the LLC.

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012). In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles. Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH, National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies. He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools. Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.