Like-Kind Exchange Documents (8 Forms, 27 Pages)

This is a package of the necessary documents to be used in connection with a like kind exchange of properties. The package contains both a straightforward Exchange Agreement between two parties in the event a situation arises where there can be a direct exchange in such a manner, and a more common, and more complex situation – a Deferred Exchange Agreement for like kind properties involving several parties and a Qualified Intermediary.

This is a package of the necessary documents to be used in connection with a like-kind exchange of properties. The package contains both a straightforward Exchange Agreement between two parties in the event a situation arises where there can be a direct exchange in such a manner, and a more common, and more complex situation – a Deferred Exchange Agreement for like kind properties involving several parties and a Qualified Intermediary.

A like-kind exchange is recognized under Code Section 1031 as a tax deferral technique. When property used in business or held for investment is exchanged for property of like kind, no gain or loss is recognized with respect to the exchange, and gain that would otherwise be recognized is deferred. When gain is deferred, a basis adjustment is made to the replacement property received by the exchanger, so that the non-recognized gain will be recognized in the future, when (or if) the replacement property is later disposed of in a taxable transaction.

Like-kind property refers to property of the same nature, character, or class. Exchanges of like-kind property can involve real property or personal property, but real property may not be exchanged for personal property. Most real estate will be considered of like kind to other real estate. The rules for personal property exchanges are much more restrictive.

Certain types of property, such as inventory, securities, partnership interests, real estate outside the

If the seller of property receives cash, has liabilities assumed, or receives nonqualifying (i.e., not like-kind) property, gain will be recognized on the receipt of such property. These assets are referred to as “boot”. Only the net boot received by a taxpayer in a transaction is taxable.

This package includes the following 8 documents:

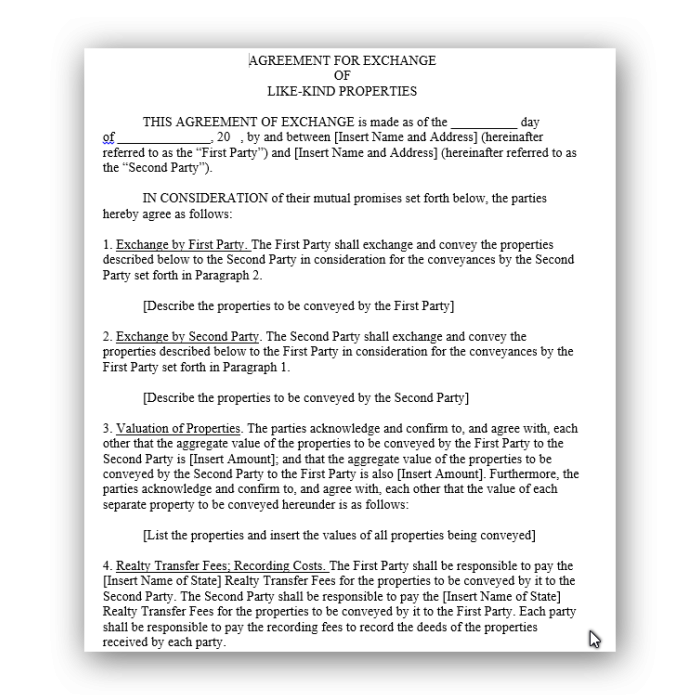

Document A: Two Party Exchange Agreement - (3 Pages)

Agreement for Exchange of Like-Kind Properties (a “simple” two party exchange)

Document B: Deferred Like-Kind Property Exchange Agreement (11 Pages)

Deferred Like Kind Property Exchange Agreement (a deferred exchange involving a Qualified Intermediary)

Document C: Assignment Agreement For Relinquished Property (2 Pages)

Assignment Agreement for the Relinquished Property (this document assigns the exchanger’s rights in the sale portion of the transaction to the Qualified Intermediary)

Document D:Addendum To Exchange Agreement (1 Page)

Addendum to the Exchange Agreement (this document is necessary so that the buyer of the relinquished property agrees to cooperate with the seller of the property (the exchanger) to allow the buyer’s role in the deferred exchange to be accomplished)

Document E: Assignment Agreement For Replacement Property (2 Pages)

Assignment Agreement for the Replacement Property (this document assigns the exchanger’s rights in the purchase portion of the transaction to the Qualified Intermediary)

Document F: Identification Notice (Three Property Rule) (1 Page)

Identification Notice – Three Property Rule (this document is used to facilitate the deferred exchange requirements)

Document G: Identification Notice (200% Property Rule) (2 Pages)

Identification Notice – 200% Rule (this document is used to facilitate the deferred exchange requirements)

Document H: Memorandum Of Information Addressing The Deferred Exchange Process (5 Pages)

Memorandum of Information Addressing the Deferred Exchange Process (this is an explanation of the various rules and requirements that must be satisfied to have a deferred exchange work successfully)

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012). In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles. Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH, National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies. He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools. Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.