Business Taxation (5 Books) - 338 Pages

Click the above "Learn More" button to view Sample Pages of the following (5) books included:

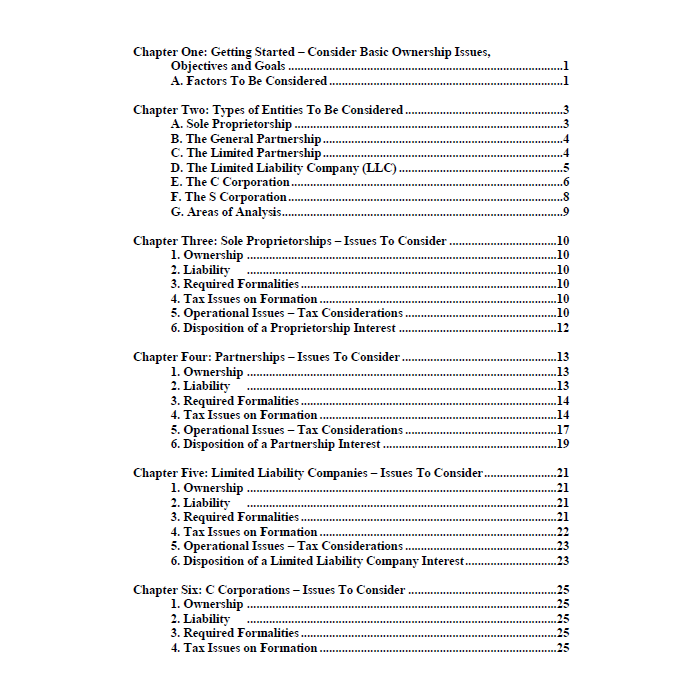

1. Business Entities: Using The Right One - 38-Page Book

Released May 26, 2011 - Written by Steven G. Siegel.

2. Buying A Business: Advising Your Client - 79-Page Book

Released May 19, 2010 - Written by Steven G. Siegel.

3. Buy-Sell Agreements And Related Tax Issues For The Closely-Held Business - 81-Page Book

Released September 21, 2009 - Written by Louis A. Mezzullo, Esquire.

4. Selling Or Gifting A Business: Advising Your Client - 111-Page Book

Released May 19, 2010 - Written by Steven G. Siegel.

5. Subchapter S Corporations: Using Trusts As Shareholders - 29-Page Book

Released August 20, 2012 - Written by Steven G. Siegel.

For Sample Pages and a Description of any of these books, please click on that book's title in the list above.

See sample pages above of each book included.

1. Business Entities: Using The Right One - 38-Page Book

Released May 26, 2011 - Written by Steven G. Siegel.

2. Buying A Business: Advising Your Client - 79-Page Book

Released May 19, 2010 - Written by Steven G. Siegel.

3. Buy-Sell Agreements And Related Tax Issues For The Closely-Held Business - 81-Page Book

Released September 21, 2009 - Written by Louis A. Mezzullo, Esquire.

4. Selling Or Gifting A Business: Advising Your Client - 111-Page Book

Released May 19, 2010 - Written by Steven G. Siegel.

5. Subchapter S Corporations: Using Trusts As Shareholders - 29-Page Book

Released August 20, 2012 - Written by Steven G. Siegel.

For Sample Pages and a Description of any of these books, please click on that book's title in the list above.

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012). In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles. Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH,National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies. He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools. Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.

-

ALL 60 Business Law Forms (60 Forms, 814 Pages)Special Price $1,299.00 Regular Price $1,963.00

ALL 60 Business Law Forms (60 Forms, 814 Pages)Special Price $1,299.00 Regular Price $1,963.00