Why Buy This Book?

1. The IRS redesigned much of the 2019 Form 1041 for the 2020 filing season. This 2020 edition includes all of those changes.

2. The 2019 Form 1041 now has a third page and also has new and rearranged lines. This 2020 edition includes all of those changes.

3. The 2019 Form 1041 added new lines, etc. for the Section 199A Deduction (Qualified Business Income Deduction). This 2020 edition includes those additions.

4. Many helpful Examples are provided.

5. Many practical Planning Tips/Considerations are given.

6. The SECURE Act has kindled renewed thinking about trust drafting and trust income tax consequences. With greater use of accumulation trusts, preparation of trust tax returns will become more complicated.

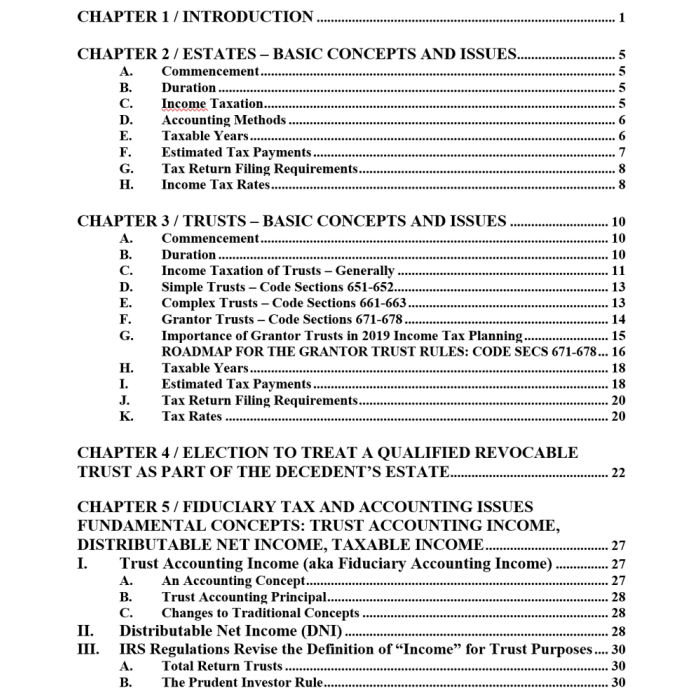

See sample pages above for the complete Table Of Contents.

Related Form(s): links to related Forms on this site appear immediately after the below "Author" curriculum vitae.

Related CLE Course: to listen to, and obtain CLE/MCLE credits in those states for which they are listed, please visit our sister sites, www.NLFonline.com (online courses) or www.NLFcle.com (courses on audio CD, flash drive and DVD), click on your state and scroll to these titles under the "Estate Planning & Taxation" heading: "The SECURE Act Big Game-Changer: Retirement Plan Distributions" and "Estate, Trust, Gift and GST Provisions of the 2017 Tax Act".

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012). In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles. Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH,

National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies. He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools. Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.

Dynasty Trust (34 Pages)$129.00

Dynasty Trust (34 Pages)$129.00