Dependent Care Assistance Plan (7 Pages)

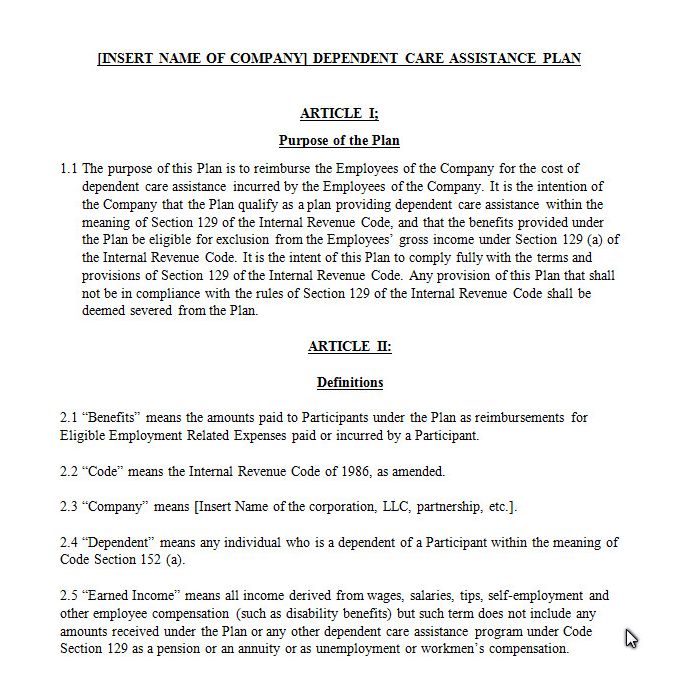

This Form creates a Dependent Care Assistance Plan as permitted by Section 129 of the Internal Revenue Code. The employer (the Company) creates the Plan for the benefit of its eligible employees, and provides a reimbursement for certain dependent care expenses as described in the Plan. Under current law, the amount which may be excluded from an employee’s income during a taxable year may not exceed $5,000 (or $2,500 in the case of a separate return filed by a married individual).

This Form creates a Dependent Care Assistance Plan as permitted by Section 129 of the Internal Revenue Code. The employer (the Company) creates the Plan for the benefit of its eligible employees, and provides a reimbursement for certain dependent care expenses as described in the Plan. Under current law, the amount which may be excluded from an employee’s income during a taxable year may not exceed $5,000 (or $2,500 in the case of a separate return filed by a married individual). This Plan makes all employees who satisfy minimal age and service criteria eligible for participation in the Plan. By law, the Plan may not discriminate in favor of highly compensated employees or their dependents.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University. He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

-

Phantom Stock Plan (8 Pages)$49.00

Phantom Stock Plan (8 Pages)$49.00