Electing Small Business Trust (13 Pages)

In stock

SKU

ElectingSmallBusinessTrust

$59.00

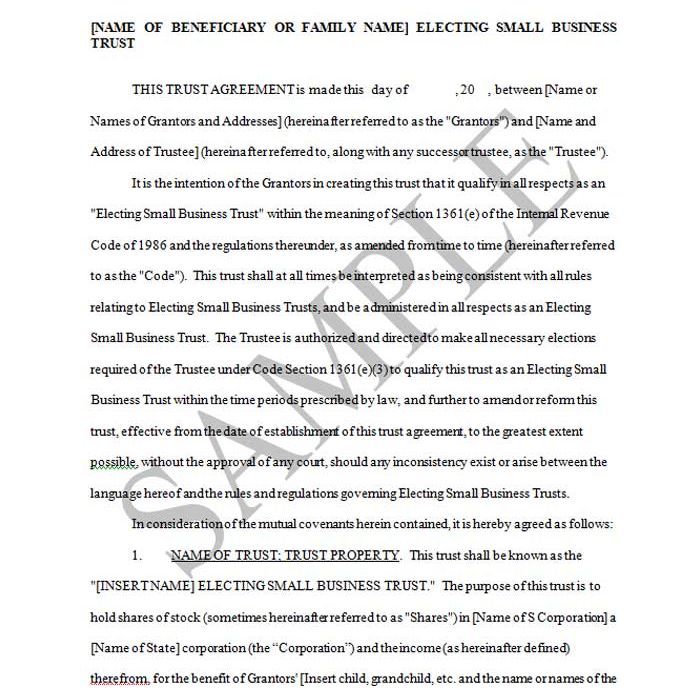

This Trust is an Electing Small Business Trust, i.e. a Trust created to follow the rules and requirements that allow this Trust to be treated as a valid S corporation shareholder. The Electing Small Business Trust is often used in estate and/or income tax planning where S corporation owners wish to transfer some of the S corporation shares, but do not wish their children to gain any control over the corporation (hence no outright transfer) or be obliged to receive annual distributions of income (as would be the requirement if a Qualified Subchapter S Trust were created). The “ESBT” allows more control of the stock and its income by the Trustee. The Trust may also hold property other than the shares of an S corporation.

This Trust is an Electing Small Business Trust, i.e. a Trust created to follow the rules and requirements that allow this Trust to be treated as a valid S corporation shareholder. The Electing Small Business Trust is often used in estate and/or income tax planning where S corporation owners wish to transfer some of the S corporation shares, but do not wish their children to gain any control over the corporation (hence no outright transfer) or be obliged to receive annual distributions of income (as would be the requirement if a Qualified Subchapter S Trust were created). The “ESBT” allows more control of the stock and its income by the Trustee. The Trust may also hold property other than the shares of an S corporation.

The Trust is irrevocable and designed to comply with the ESBT requirements. As drafted, it is created by two grantors, husband and wife, and designed as a single beneficiary trust, but could be modified to accommodate additional beneficiaries. It contains a Crummey right of withdrawal for the beneficiary. This is intended to make certain that the Grantors are eligible for both the present interest gift tax and generation-skipping tax exclusions. If the Trust is prepared to permit multiple beneficiaries, unless such beneficiaries are granted separate shares in the trust, the present interest gift tax exclusion and the present interest generation skipping tax exclusion would be denied.

Note in Article 3, the income of the trust may be expended, in the trustee’s discretion, for the Beneficiary’s health, education, maintenance and support. Principal may be paid to the Beneficiary one-half at age 25, and the balance at age 30. These ages and the distribution percentages may, of course, be modified, as appropriate. The client should be made aware of the rather unfavorable ESBT income tax treatment, at least to the extent the income of the ESBT arises from the business activities of the S corporation. Such income is taxed at the highest income tax rates, and many deductions and exemptions are denied. The unfavorable income tax rules apply only to the income generated by the S corporation shares. Income from other property held in the ESBT is treated in the same manner as any other trust income.

Note further that as the result of the 2017 Tax Cuts and Jobs Act (the “Act”), persons who are nonresident aliens are now permitted to be shareholders of an ESBT, and that the Act now allows an ESBT to make charitable contributions in accordance with the rules of IRC 170 applicable to individuals, which rules are less restrictive than the former requirement that gifts to charity from an ESBT follow the rules applicable to gifts from trusts of IRC 642(c).

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization. Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected]

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization. Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected]

We found other products you might like!

-

Trusts (8 Books) - 313 PagesSpecial Price $129.00 Regular Price $160.00

Trusts (8 Books) - 313 PagesSpecial Price $129.00 Regular Price $160.00 -

Dynasty Trust (34 Pages)$129.00

Dynasty Trust (34 Pages)$129.00