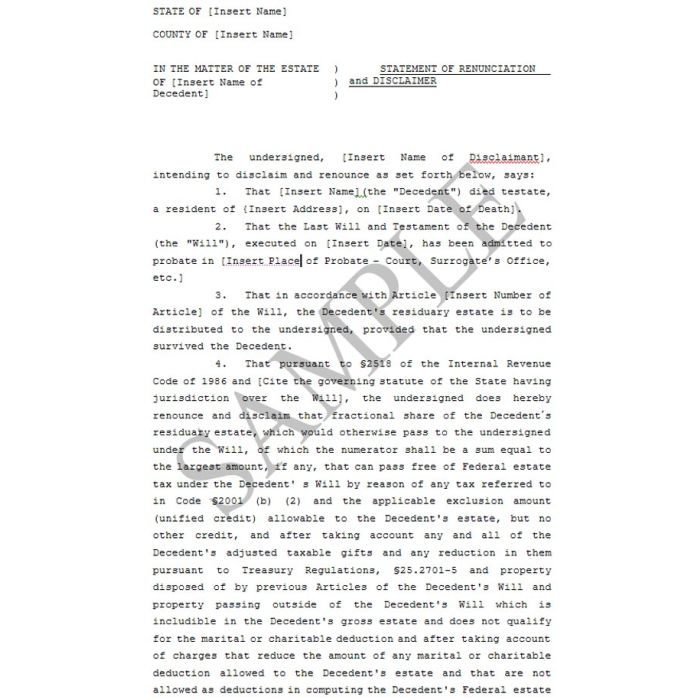

Fractional Share Disclaimer Of Optimal Credit Shelter Amount (3 Pages)

In stock

SKU

fractionalsharedisclaim

$19.00

This Form is a Qualified Disclaimer under Code Section 2518. It is used to allow an heir to disclaim one or more items of property that would otherwise pass to the heir from the decedent either under the Will of the decedent or outside the Will of the decedent, such as by contract or beneficiary designation.

To be considered a qualified disclaimer, the document must be signed and delivered within nine months of the decedent’s date of death. The person disclaiming must not have received any benefit from the property being disclaimed, and may not direct where the disclaimed property should go. By disclaiming, the party so acting is allowing the disclaimed property to pass to the heirs next in line of succession, without being treated as having made a gift of the disclaimed property to such heirs.

This Form is a Qualified Disclaimer under Code Section 2518. It is used to allow an heir to disclaim one or more items of property that would otherwise pass to the heir from the decedent either under the Will of the decedent or outside the Will of the decedent, such as by contract or beneficiary designation.

To be considered a qualified disclaimer, the document must be signed and delivered within nine months of the decedent’s date of death. The person disclaiming must not have received any benefit from the property being disclaimed, and may not direct where the disclaimed property should go. By disclaiming, the party so acting is allowing the disclaimed property to pass to the heirs next in line of succession, without being treated as having made a gift of the disclaimed property to such heirs.

In this Form, the person disclaiming is trying to direct the optimal amount of property owned by the decedent to a credit shelter trust created by the decedent under his or her Will or Revocable Trust. The disclaimer creates a formula stated as a fraction designed to have the executor fund the credit shelter share of the decedent’s estate plan with exactly the “correct” amount to benefit fully from the credit shelter opportunity.

This disclaimer is often used as part of a designed plan to allow a surviving spouse to disclaim an amount of property at the death of a decedent spouse to get just the right division between the marital deduction portion of the estate and the credit shelter portion. The fiduciary of the decedent’s estate may then select the assets from the decedent’s estate to be used to fund both the credit shelter portion and the marital deduction portion of the plan.

While this may be done, it is not the only form a disclaimer may take. A disclaimer need not be an all or nothing decision. It is also permissible to disclaim specific items of property left by a decedent, either under the decedent’s Will, or outside the Will, by contract, beneficiary designation, etc. It is also possible for the disclaimant to disclaim all of the property left to him or her, including, without limitation, his or her survivorship interest in any joint property of which the disclaimant and the decedent were joint tenants.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.