GRAT (Grantor Retained Annuity Trust) (32 Pages)

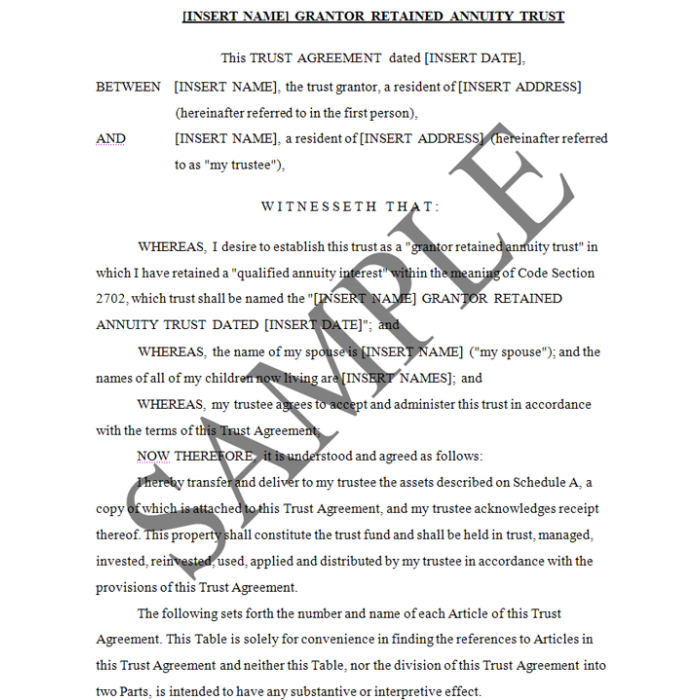

This is a form of a GRAT that is designed to qualify as a “zeroed out” i.e. no gift tax GRAT. It follows the Walton case and the IRS regulations that permit a GRAT to achieve this result. The form is divided into two Parts. Part One describes a number of provisions for the succession of the property, including a continuing trust for the children of the grantor and a fall-back marital deduction trust for the grantor’s spouse, if necessary. Part Two describes a variety of administrative provisions to govern the management of the Trust.

Pressing Planning Suggestions From Steve Siegel: Possible law changes in 2022 may have an adverse effect on clients’ tax and estate planning. Many of the planning techniques available in 2020 were targeted for elimination by the Obama administration, and are again raised in the platform of the Biden administration.

The estate tax exclusion for 2022 is $12.06 million. If it is reduced under the Biden administration, have clients address gifting as suggested as well as “freezing” the value of their assets now at current levels so that future appreciation belongs to their heirs, not to their future estates. One of several planning techniques is to transfer property or an interest in a family business to a Grantor Retained Annuity Trust (GRAT) to freeze future appreciation.

This is a form of a GRAT that is designed to qualify as a “zeroed out” i.e. no gift tax GRAT. It follows the Walton case and the IRS regulations that permit a GRAT to achieve this result. The form is divided into two Parts. Part One describes a number of provisions for the succession of the property, including a continuing trust for the children of the grantor and a fall-back marital deduction trust for the grantor’s spouse, if necessary. Part Two describes a variety of administrative provisions to govern the management of the Trust.

The grantor of a GRAT may be its trustee, at least for the duration of the initial retained interest term. In entering a GRAT transaction, it is necessary to make an actuarial calculation that takes into account the desired retained interest of the grantor, the duration of the trust, the age of the grantor and the applicable federal interest rate at the time the property is transferred to the GRAT. All of these factors must be addressed if the GRAT is to be “zeroed out”, if that is the grantor’s intention.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization. Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].

-

Dynasty Trust (34 Pages)$129.00

Dynasty Trust (34 Pages)$129.00 -

2 QPRT Forms (28 Pages)$99.00

2 QPRT Forms (28 Pages)$99.00