Incentive Trusts (43-Page Book)

Released January 4, 2012 - Written by Louis A. Mezzullo, Esquire.

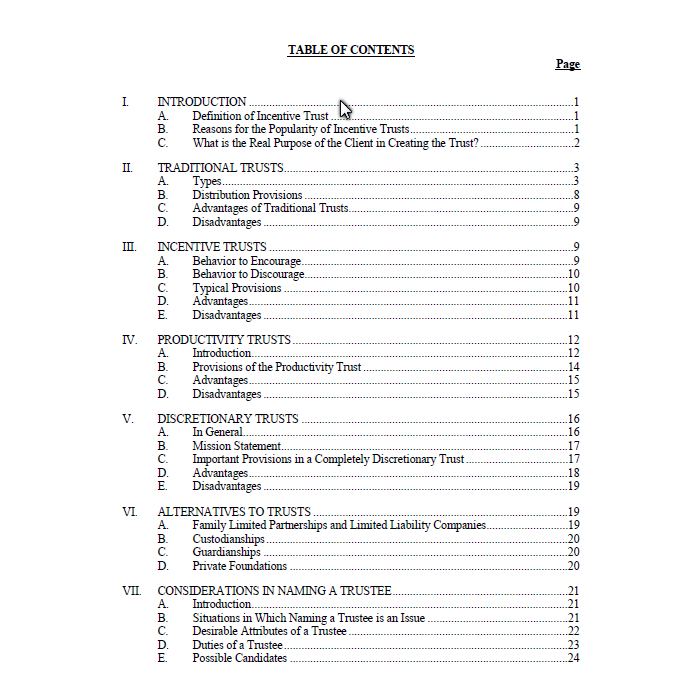

Click the above "Learn More" button to read the Table of Contents, several Sample Pages and Mr. Mezzullo's curriculum vitae.

See sample pages above for the complete Table Of Contents. Alternatively, here are the main topics covered in this book:

I. INTRODUCTION

A. Definition of Incentive Trust

B. Reasons for the Popularity of Incentive Trusts

C. What is the Real Purpose of the Client in Creating the Trust?

II. TRADITIONAL TRUSTS

A. Types

B. Distribution Provisions

C. Advantages of Traditional Trusts

D. Disadvantages

III. INCENTIVE TRUSTS

A. Behavior to Encourage

B. Behavior to Discourage

C. Typical Provisions

D. Advantages

E. Disadvantages

IV. PRODUCTIVITY TRUSTS

A. Introduction

B. Provisions of the Productivity Trust

C. Advantages

D. Disadvantages

V. DISCRETIONARY TRUSTS

A. In General

B. Mission Statement

C. Important Provisions in a Completely Discretionary Trust

D. Advantages

E. Disadvantages

VI. ALTERNATIVES TO TRUSTS

A. Family Limited Partnerships and Limited Liability Companies

B. Custodianships

C. Guardianships

D. Private Foundations

VII. CONSIDERATIONS IN NAMING A TRUSTEE

A. Introduction

B. Situations in Which Naming a Trustee is an Issue

C. Desirable Attributes of a Trustee

D. Duties of a Trustee

E. Possible Candidates

F. Who May Serve as Trustee

G. Mechanics in Naming a Successor Trustee

H. Mechanics in Removing a Current Trustee

I. Tax Considerations

J. Types of Trusts

K. Reasons for Using Trusts

L. Compensation of Trustees

M. Protection of Trustees from Liability

N. Liability of Trustees

O. Powers of a Trustee

P. Providing Flexibility

Q. Situs of the Trust

VIII. SAMPLE LANGUAGE

IX. DISCUSSION QUESTIONS

X. BIBLIOGRAPHY

XI. SELECTED PROVISIONS FROM THE UNIFORM TRUST CODE

A. Section 813. Duty to Inform and Report

B. Section 103(12)

XII. SELECTED PROVISIONS FROM THE OHIO REVISED CODE

A. 5808.13 Keeping beneficiaries informed - requests - required reports

B. 5801.01 General definitions

C. 5801.04 Trustee powers, duties, and relations - beneficiaries’ rights

D. 5808.14 Judicial standard of review for discretionary trusts

Related Form(s): links to related Forms on this site appear immediately after the below "Author" curriculum vitae.

Author:

Louis A. Mezzullo is a partner in Withers Bergman LLP, practicing principally out of its Rancho Santa

Fe, CA office. His principal areas of practice are taxation, estate and business planning, and employee benefits.

He was an Adjunct Professor of Law at the University of Richmond Law School from 1978 to 2006, where he

taught courses in those subjects and was on the faculty of the University of Miami School of Law Graduate

Program in Estate Planning from 2004 until 2007. He also lectures for the Continuing Legal Education

Committee of the Virginia Bar Foundation. He is listed in Who's Who in American Law, Who's Who in Emerging

Leaders and Who’s Who in America (Marquis Who's Who Publishers) and in The Best Lawyers in America (for

tax, employee benefits and trust and estates) (Woodward/White Publishers). He has written articles on the

subjects of taxation, estate planning and employee benefits for the Journal of Taxation, University of Richmond

Law Review, Virginia Bar Association Journal, Estate Planning, ACTEC Journal, Probate & Property, Taxation

for Accountants, Taxation for Lawyers, Taxation of Employee Benefits, Journal of Passthrough Entities, Business

Entities, and Trusts & Estates. He has authored An Estate Planner’s Guide to Buy-Sell Agreements, An Estate

Planner’s Guide to Life Insurance, An Estate Planner's Guide to Qualified Retirement Plan Benefits (1st, 2nd, 3rd, and 4th editions), An Estate Planner's Guide to Family Business Entities (1st and 2nd editions), and Valuation Rules Under Chapter 14, all published by the American Bar Association Section of Real Property, Probate and Trust Law; co-authored Advising the Elderly Client, published by Clark Boardman Callaghan; authored Transfers of Interests in Family Entities Under Chapter 14: Sections 2701, 2703, and 2704, 835 Tax ManagementPortfolio (3rd edition); The Migrant Client: Tax, Community Property, etc., 803 Tax Management Portfolio; Estate Planning for Owners of Closely Held Business Interests, 809 Tax Management Portfolio (2nd edition); Family Limited Partnerships and Limited Liability Companies, 812 Tax Management Portfolio; Estate and Gift Tax Issues for Employee Benefit Plans, 378 Tax Management Portfolio (1st, 2nd, and 3rd editions); and Valuation of Corporate Stock, 831 Tax Management Portfolio (3rd edition), all published by the Bureau of National Affairs,Inc.; and was editor and co-author of Limited Liability Companies in Virginia, published by the Virginia LawFoundation. He has spoken at numerous tax and estate planning conferences, including the Heckerling Institute on Estate Planning, the University of Southern California Institute on Federal Taxation, the Notre Dame Estate Planning Conference, the Mid-America Tax Conference, the Heart of America Tax Conference, the William and Mary Tax Conference, and the Virginia Federal Tax Conference.

Mezzullo received his J.D. from the University of Richmond Law School, and a B.A. and M.A. from the

University of Maryland. He is a past Chair of the American College of Tax Counsel; a Fellow of the American

Bar Foundation; a Fellow of the Virginia Law Foundation; the Secretary and Regent of the American College of

Trust and Estate Counsel, as well as former Chair of its Business Planning, Employee Benefits in Estate Planning,and Elder Law Committees; a Charter Fellow of the American College of Employee Benefits Counsel; an Academician and Vice President of the International Academy of Trust and Estate Law; and a member of the

Virginia State Bar; California State Bar, and American Bar Association, a Vice-chair of the ABA Section of

Taxation and current Chair of the Business Planning Subcommittee of its Estate and Gift Taxes Committee; and

past Chair of the ABA Section of Real Property, Probate and Trust Law. He is also a member of the Heckerling Institute on Estate Planning Advisory Committee, a member and former Chair of the University of Richmond Estate Planning Advisory Council, former President of the Trust Administrator's Council of Richmond, and former co-director of the William and Mary Tax Conference. He is currently a member of the Editorial Board of the ACTEC Journal and the Journal of Passthrough Entities and a former member of the Editorial Board of Trusts & Estates magazine, and former editor of ACTEC Journal. Mezzullo is also a former member of the Board of Associates of the University of Richmond and former Chair of the Business Council of the Virginia Museum of Fine Arts and a former member of the Board of Directors of the Virginia Museum of Fine Arts Foundation. He is a member of the Board of Directors of the San Diego Opera and the Gift Planning Advisors Council of the San Diego YMCA. He is a former member of the Advisory Committee of the Virginia Opera, the Board of Directors of the American Heart Association, Virginia Affiliate, the Richmond Symphony, the Richmond Ballet, and Willow Oaks Country Club. He was also President of the Southampton Citizens Association in 1972, and from 1985 to 1987.