New IRC Section 199A - the 20% Qualified Business Income Deduction - is one of the most complicated and important provisions of the 2017 Tax Cuts and Jobs Act. The government, in their own statistics, indicated that they expected 10 million taxpayers will be effected by Code Section 199A.

Practitioners must first determine whether a business client qualifies for 199A. Steve Siegel, the author, has created a three-easy-step method to make that determination. In this valuable book, Mr. Siegel fully explains this useful method and includes practical examples and planning suggestions.

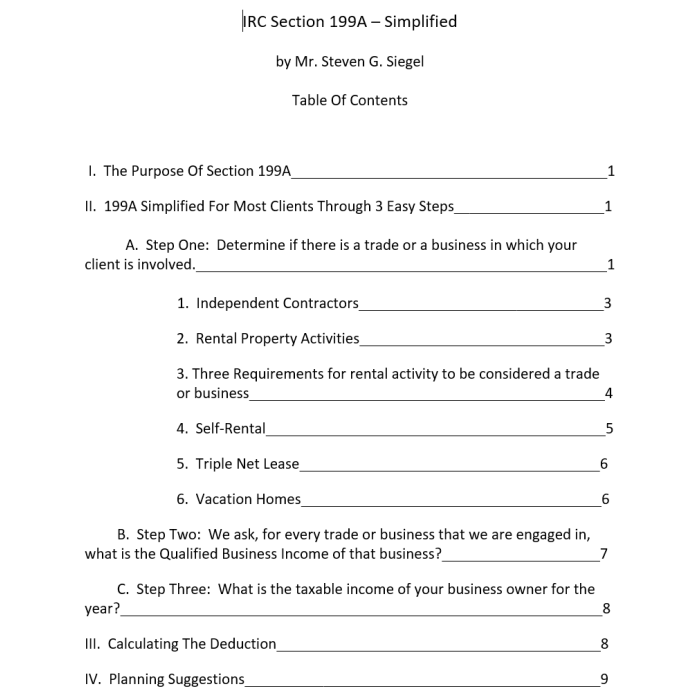

TABLE OF CONTENTS:

I. The Purpose Of Section 199A

II. 199A Simplified For Most Clients Through 3 Easy Steps

A. Step One: Determine if there is a trade or a business in which your client is involved

1. Independent Contractors

2. Rental Property Activities

3. Three Requirements for rental activity to be considered a trade or business

4. Self-Rental

5. Triple Net Lease

6. Vacation Homes

B. Step Two: We ask, for every trade or business that we are engaged in, what is the Qualified Business Income of that business?

C. Step Three: What is the taxable income of your business owner for the year?

III. Calculating The Deduction

IV. Planning Suggestions

Prefer Mr. Siegel's Audio Explanation? Clickhere: IRC Sec. 199A Simplified (43-Minute Audio Recording)

(The contents of the book are covered in the audio explanation.)

Author:

Steven G. Siegel is president of The Siegel Group, which provides consulting services to attorneys, accountants, business owners, family offices and financial planners. Based in Morristown, New Jersey, the Group provides services throughout the United States. Mr. Siegel is the author of many books, including: The Grantor Trust Answer Book (2012 and 2013 CCH); CPA’s Guide to Financial and Estate Planning (AICPA 2012); and Federal Fiduciary Income Taxation (Foxmoor 2012). In conjunction with numerous tax planning lectures he has delivered for the National Law Foundation, Mr. Siegel has prepared extensive lecture materials on the following subjects: Planning for An Aging Population; Business Entities: Start to Finish; Preparing the Audit-Proof Federal Estate Tax Return; Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts, Introduction to Estate Planning; Intermediate-Sized Estate Planning; Social Security, Medicare and Medicaid: Explanation and Planning Strategies; Subchapter S Corporations: Using Trusts as Shareholders; Divorce and Separation: Important Tax Planning Issues; The Portability Election; Generation-Skipping Transfer Tax: A Comprehensive Review; and many other titles. Mr. Siegel has delivered hundreds of lectures to thousands of attendees in live venues and via webinars throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including The Heckerling Institute on Tax Planning, CCH, National Law Foundation, AICPA, Western CPE, the National Society of Accountants, the National Tax Institute, Cohn-Reznick, Professional Education Systems, Inc., Foxmoor Education, many State Accounting Societies and Estate Planning Councils as well as on behalf of private companies. He is presently serving as an adjunct professor of law in the Graduate Tax Program (LLM) of the University of Alabama, and has served as an adjunct professor of law at Seton Hall and Rutgers University law schools. Mr. Siegel holds a bachelor’s degree from Georgetown University (magna cum laude, phi beta kappa), a juris doctor from Harvard Law School and an LLM in taxation from New York University Law School.