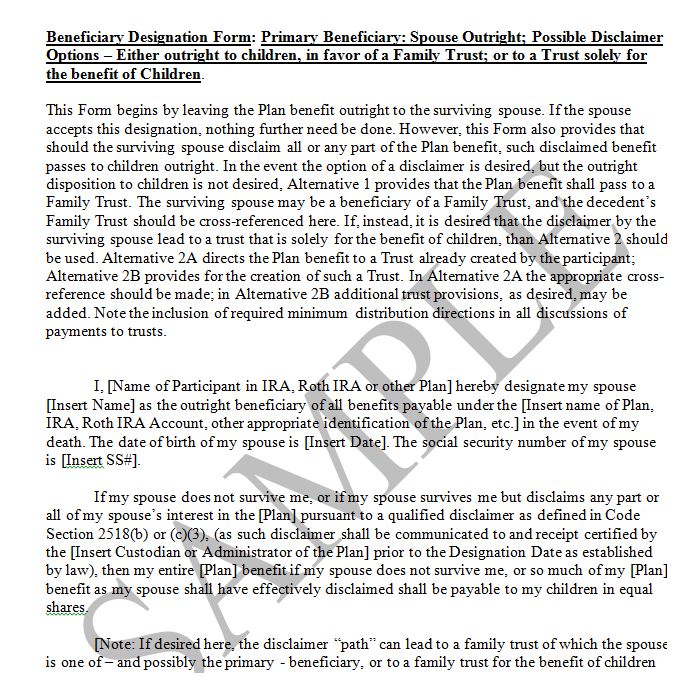

Beneficiary Designation Form: Primary Beneficiary: Spouse Outright; Possible Disclaimer Options – Either Outright To Children, In Favor Of A Family Trust; Or To A Trust Solely For The Benefit Of Children

This Form begins by leaving the Plan benefit outright to the surviving spouse. If the spouse accepts this designation, nothing further need be done. However, this Form also provides that should the surviving spouse disclaim all or any part of the Plan benefit, such disclaimed benefit passes to children outright. In the event the option of a disclaimer is desired, but the outright disposition to children is not desired, Alternative 1 provides that the Plan benefit shall pass to a Family Trust. The surviving spouse may be a beneficiary of a Family Trust, and the decedent’s Family Trust should be cross-referenced here. If, instead, it is desired that the disclaimer by the surviving spouse lead to a trust that is solely for the benefit of children, then Alternative 2 should be used. Alternative 2A directs the Plan benefit to a Trust already created by the participant; Alternative 2B provides for the creation of such a Trust. In Alternative 2A the appropriate cross-reference should be made; in Alternative 2B additional trust provisions, as desired, may be added. Note the inclusion of required minimum distribution directions in all discussions of payments to trusts.

This Form begins by leaving the Plan benefit outright to the surviving spouse. If the spouse accepts this designation, nothing further need be done. However, this Form also provides that should the surviving spouse disclaim all or any part of the Plan benefit, such disclaimed benefit passes to children outright. In the event the option of a disclaimer is desired, but the outright disposition to children is not desired, Alternative 1 provides that the Plan benefit shall pass to a Family Trust. The surviving spouse may be a beneficiary of a Family Trust, and the decedent’s Family Trust should be cross-referenced here. If, instead, it is desired that the disclaimer by the surviving spouse lead to a trust that is solely for the benefit of children, then Alternative 2 should be used. Alternative 2A directs the Plan benefit to a Trust already created by the participant; Alternative 2B provides for the creation of such a Trust. In Alternative 2A the appropriate cross-reference should be made; in Alternative 2B additional trust provisions, as desired, may be added. Note the inclusion of required minimum distribution directions in all discussions of payments to trusts.

Author:

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].