Revocable Trust For Spouse And Children With Marital Share Outright (16 Pages)

In stock

SKU

RevocableTrustSpouseChildren

$49.00

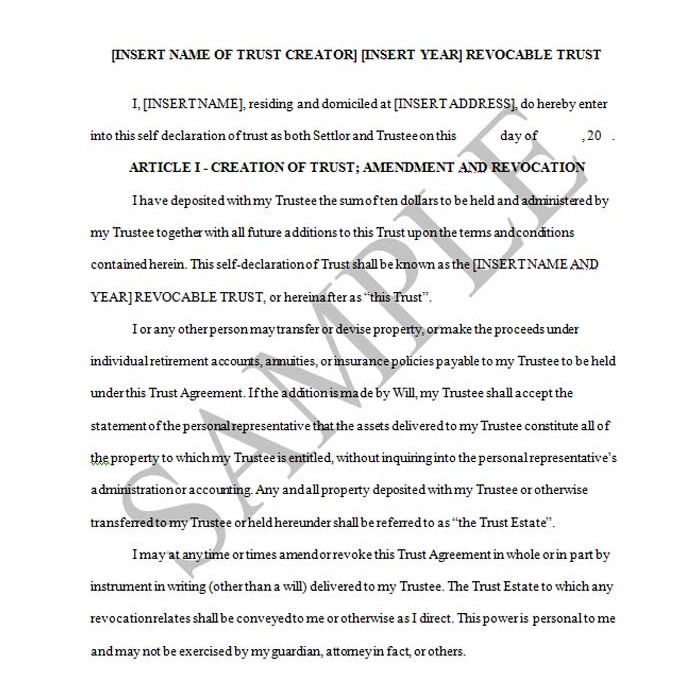

This document is a self-declaration of trust by the grantor/trustee. The “grantor” may also be referred to as the “settlor”, as in this form. It contains life benefit directives for the grantor, as well as the dispositive provisions of the grantor’s estate plan. It is completely revocable by the grantor while living. It is intended to be used in conjunction with a pour-over will. The pour-over will names this trust as the beneficiary of any of the grantor’s probate assets that pass by the grantor’s will. Such assets are then administered in accordance with the terms of this trust, along with assets that are already titled in the name of the trust. The intent in using this trust is to have most or all of the grantor’s property titled in the name of this trust while the grantor is alive in order to avoid probate. The Revocable Living Trust is commonly used in those states where probate is difficult, expensive, cumbersome, time-consuming, delay-inducing, etc.

This document is a self-declaration of trust by the grantor/trustee. The “grantor” may also be referred to as the “settlor”, as in this form. It contains life benefit directives for the grantor, as well as the dispositive provisions of the grantor’s estate plan. It is completely revocable by the grantor while living. It is intended to be used in conjunction with a pour-over will. The pour-over will names this trust as the beneficiary of any of the grantor’s probate assets that pass by the grantor’s will. Such assets are then administered in accordance with the terms of this trust, along with assets that are already titled in the name of the trust. The intent in using this trust is to have most or all of the grantor’s property titled in the name of this trust while the grantor is alive in order to avoid probate. The Revocable Living Trust is commonly used in those states where probate is difficult, expensive, cumbersome, time-consuming, delay-inducing, etc.

The Revocable Living Trust is also useful as a management document to handle the affairs of an elderly relative even when probate issues are not a concern. Persons owning property in multiple states may consider using this Trust to avoid the costs of ancillary probate in those states, some of which might have burdensome probate rules.

By the terms of this trust, the grantor is in complete control of the trust property while alive, unless becoming incompetent (as explained in Article 3.2), in which case one or more additional trustees are appointed to manage the grantor’s affairs. Since the grantor has retained control over the assets of the trust, the trust income is taxable to the grantor, and the fair market value of the trust property is included in the grantor’s estate at the grantor’s death.

Article 4 contains the dispositive provisions of this trust that take effect when the grantor dies. Here, the grantor’s spouse receives the trust property outright, but is given the opportunity to disclaim some or all of this bequest and have the disclaimed property used to fund a unified credit shelter bypass trust in which the spouse and children are the permitted beneficiaries.

At the second death of the spouses, the balance of the trust property passes outright to the children of the grantor. If a child predeceases the grantor, leaving issue surviving, the child’s share passes to such issue – outright if they have attained age 35, in further trust if they have not. If a trust is created for any issue, it lasts until the trust beneficiary has reached age 35. One-half of the trust principal is distributed to such beneficiary when the beneficiary attains age 30.

At the second death of the spouses, the balance of the trust property passes outright to the children of the grantor. If a child predeceases the grantor, leaving issue surviving, the child’s share passes to such issue – outright if they have attained age 35, in further trust if they have not. If a trust is created for any issue, it lasts until the trust beneficiary has reached age 35. One-half of the trust principal is distributed to such beneficiary when the beneficiary attains age 30.

As written, the trust assumes a married male settlor and a wife. Of course, the designations of “wife” can be changed to “husband” as appropriate.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.