Pour-Over Will (8 Pages)

In stock

SKU

PourOverWill

$49.00

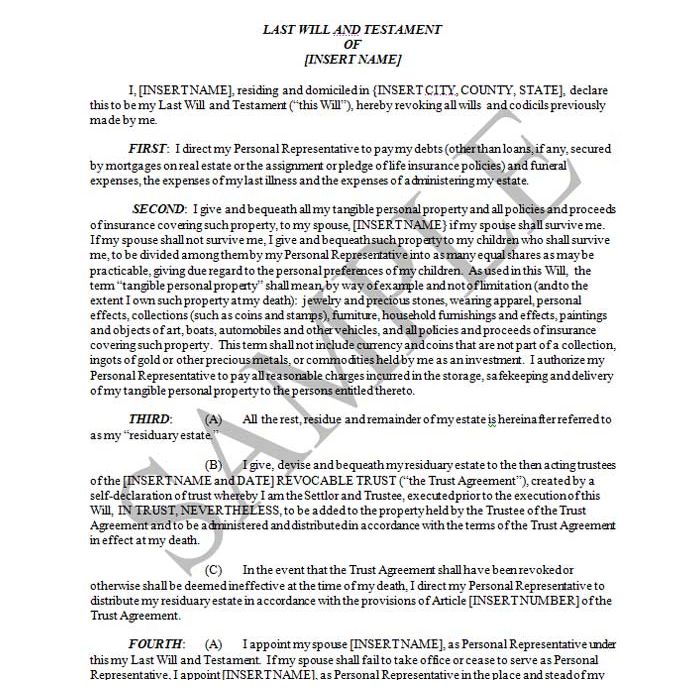

This is a Pour-Over Will. It is designed to be prepared in concert with a Revocable Living Trust signed by the Testator prior to the signing of this Will. The Will leaves the Testator’s residuary estate to the then acting Trustee of the Revocable Living Trust to be administered in accordance with the terms of the Trust. By using this combination of Pour-Over Will and Revocable Living Trust, there is not any duplication of property disposition and estate administration.

This is a Pour-Over Will. It is designed to be prepared in concert with a Revocable Living Trust signed by the Testator prior to the signing of this Will. The Will leaves the Testator’s residuary estate to the then acting Trustee of the Revocable Living Trust to be administered in accordance with the terms of the Trust. By using this combination of Pour-Over Will and Revocable Living Trust, there is not any duplication of property disposition and estate administration. Note the provision of Article Third (C) which refers to and confirms the disposition of property in accordance with the terms of the Revocable Living Trust even if the Trust is revoked in the future. This provision is included to avoid an inadvertent “gap” in the testator’s estate plan, but as a practical matter, if the Revocable Living Trust is amended or revoked for any reason, this cross-reference in the Pour-Over Will should be re-examined, and, if necessary, a new Pour-Over Will or Codicil should be prepared.

Note also the provisions of Article Fifth which allow the Personal Representative to either collect funds from the Revocable Trust to pay taxes and administration expenses, or allow the Trustee of the Revocable Trust to pay these expenses directly. These provisions are included to address the possibility of different state laws that may impose this obligation on the Personal Representative – or allow it to be delegated to the Trustee. Article Fifth also gives the Personal Representative the authority to make the various tax elections which are permitted by the Internal Revenue Code and which are said to be the responsibility of the Personal Representative. As a practical matter, wherever possible, it is recommended that the Personal Representative and the Trustee of the Revocable Trust be the same person so that potential conflicts are avoided.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].

Note also the provisions of Article Fifth which allow the Personal Representative to either collect funds from the Revocable Trust to pay taxes and administration expenses, or allow the Trustee of the Revocable Trust to pay these expenses directly. These provisions are included to address the possibility of different state laws that may impose this obligation on the Personal Representative – or allow it to be delegated to the Trustee. Article Fifth also gives the Personal Representative the authority to make the various tax elections which are permitted by the Internal Revenue Code and which are said to be the responsibility of the Personal Representative. As a practical matter, wherever possible, it is recommended that the Personal Representative and the Trustee of the Revocable Trust be the same person so that potential conflicts are avoided.

Author:

Steven G. Siegel is president of The Siegel Group, a Morristown, New Jersey - based national consulting firm specializing in tax consulting, estate planning and advising family business owners and entrepreneurs. Mr. Siegel holds a BS from Georgetown University, a JD from Harvard Law School and an LLM in Taxation from New York University.

He is the author of several books, including: Planning for An Aging Population; Business Entities: Start to Finish; Taxation of Divorce and Separation; Income Taxation of Estates and Trusts, Preparing the Audit-Proof Federal Estate Tax Return, Putting It Together: Planning Estates for $5 million and Less, Family Business Succession Planning, Business Acquisitions: Representing Buyers and Sellers in the Sale of a Business; Dynasty Trusts; Planning with Intentionally-Defective Grantor Trusts; The Federal Gift Tax: A Comprehensive Analysis; Charitable Remainder Trusts, Grantor Trust Planning: QPRTs, GRATs and SCINs, The Estate Planning Course, The Retirement Planning Course, Retirement Distributions: Estate and Tax Planning Strategies; The Estate Administration Course, Tax Strategies for Closely-Held Businesses, and Tort Litigation Settlements: Tax and Financial Issues.

Mr. Siegel has lectured extensively throughout the United States on tax, business and estate planning topics on behalf of numerous organizations, including National Law Foundation, AICPA, CCH, National Tax Institute, National Society of Accountants, and many others. He has served as an adjunct professor of law at Seton Hall and Rutgers University law schools.

The Siegel Group provides consulting services to accountants, attorneys, financial planners and life insurance professionals to assist them with the tax, estate and business planning and compliance issues confronting their clients. Based in Morristown, New Jersey, the Group has provided services throughout the United States. The Siegel Group does not sell any products. It is an entirely fee-based organization.

Contact the Siegel Group through its president, Steven G. Siegel, e-mail: [email protected].